Lately, headlines have been buzzing about the rise in new home inventory, noting that we’re now seeing levels not experienced since 2009. If that immediately brings to mind the housing crash of the late 2000s, you’re not alone — and it’s completely understandable to feel a little uneasy.

But before jumping to conclusions or letting fear take the wheel, it’s worth remembering that headlines are often designed to grab attention. They’re built for clicks, not clarity. And while they may highlight eye-catching stats, they don’t always provide the full picture or the context you need to truly understand what’s happening.

So rather than getting caught up in the noise, let’s take a step back, dig into the data, and look at what’s really going on in today’s housing market. Because when we view the numbers with perspective, the story becomes a lot clearer — and a lot less alarming.

Why This Isn’t Like 2008

It’s true—new home inventory has reached its highest level since 2009. But that headline alone doesn’t tell the full story, and it’s definitely not a reason to panic.

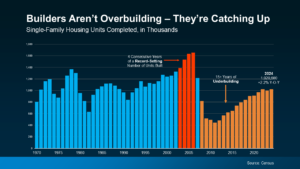

Here’s the key context to keep in mind: when you look at the data visually, it becomes clear that 2009 wasn’t the peak of the oversupply issue — not even close. The real spike in inventory happened earlier, around 2007 to 2008, right before the market downturn. In fact, by 2009, the number of new homes being built was already on the decline.

So while comparisons to 2009 might seem concerning at first glance, the data tells a much more balanced story. (Take a look at the graph below for a clearer picture.)

The overbuilding that played a major role in the housing crash actually happened in the years leading up to 2008—not in 2009. By the time we hit 2009, construction activity was already tapering off in response to the downturn. So when you hear that today’s inventory levels are similar to those in 2009, it’s important to understand that it’s not the same situation. Reaching 2009 levels doesn’t mean we’re repeating the overbuilding patterns of the past. Context matters—and in this case, it makes all the difference.

Builders Have Actually Underbuilt for Over a Decade

Let’s take a look at some more data to put things in perspective. After the housing crash, builders dramatically scaled back production. In fact, they built far fewer homes than the market actually needed — and that trend continued for over a decade.

This prolonged period of underbuilding led to a significant housing shortage, and it’s a challenge we’re still dealing with today.

The graph below, based on Census data, illustrates this clearly. You’ll see the spike in overbuilding leading up to the crash (highlighted in red), followed by an extended stretch of underbuilding (in orange). Only recently have we started to return to more typical levels of new home construction.

Today’s market is a very different story. Builders aren’t overbuilding — they’re finally catching up.

In a recent article, Odeta Kushi, Deputy Chief Economist at First American, explains why the increase in new construction is actually a positive sign, particularly for buyers. She says:

“This means more homes on the market and more options for home buyers, which is good news for a housing market that has been underbuilt for over a decade.”

Of course, like anything in real estate, supply and demand can vary by location. Some markets may see more new construction than others. But on a national level, the numbers point to a healthier, more balanced market — not a cause for concern or comparison to the last crash.

Bottom Line

No matter what the headlines say, the increase in newly built homes on the market isn’t a red flag—at least not on a national level. It’s actually a positive sign that builders are beginning to catch up after years of underbuilding.

If you’re curious about what this means for our local market or thinking about making a move, let’s connect. We’d be happy to walk you through the latest trends and what they mean for you.