If you have been waiting for mortgage rates to drop, you are in luck because they have started to come down. The question now is whether this trend will continue and how low rates might go.

According to housing market experts, there is still room for mortgage rates to decrease further over the next year. One important factor to keep an eye on is the 10-year Treasury yield, a key indicator that often influences where mortgage rates are headed.

The Link Between Mortgage Rates and the 10-Year Treasury Yield

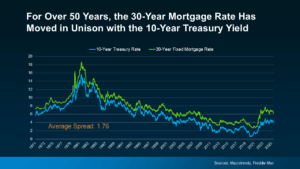

For more than 50 years, the 30-year fixed mortgage rate has closely followed the movement of the 10-year Treasury yield. This yield is widely used as a benchmark for long-term interest rates, offering valuable insight into the direction of the housing market and borrowing costs (see graph below):

When the 10-year Treasury yield increases, mortgage rates usually rise as well. On the other hand, when the yield declines, mortgage rates tend to move lower too.

This pattern has remained consistent for more than 50 years. It is so reliable that experts often refer to a typical difference between the two, known as the spread. Historically, this spread averages around 1.76 percentage points, or 176 basis points, and helps analysts gauge whether mortgage rates are in a normal range or trending higher than expected.

The Spread Is Shrinking

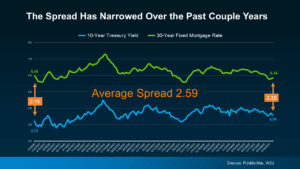

In the past few years, the spread between the 10-year Treasury yield and mortgage rates has been much wider than normal. The reason comes down to market uncertainty. You can think of the spread as a reflection of investor confidence. When there is uncertainty in the economy, that gap tends to widen, which helps explain why mortgage rates have remained higher than expected in recent years.

There is good news on the horizon. Although some uncertainty still exists, the spread has started to narrow as the economic outlook becomes clearer. This shift suggests that mortgage rates may continue to ease in the coming months, giving buyers and homeowners a reason to stay optimistic about the housing market.

As the spread continues to narrow, it creates an opportunity for mortgage rates to decline even further. According to a recent report from Redfin, this relationship is clear:

“A lower mortgage spread equals lower mortgage rates. If the spread continues to decline, mortgage rates could fall more than they already have.”

This trend offers a promising outlook for both buyers and homeowners who have been waiting for a more favorable time to make a move. If the current momentum continues, the housing market could see more activity as affordability gradually improves.

The 10-Year Treasury Yield Is Expected To Decline

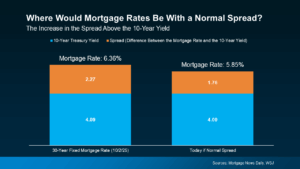

It is not only the spread influencing where mortgage rates are headed. The 10-year Treasury yield itself is also expected to decline in the coming months. When a lower yield combines with a narrowing spread, these two forces work together to help drive mortgage rates down as we move into next year.

This long-standing relationship helps explain why many housing market experts predict that mortgage rates will continue to ease, with a small chance they could reach the upper 5 percent range by the end of next year.

Here is a simple way to understand the math behind it. If the 10-year Treasury yield is currently around 4.09%, and you add the typical spread of 1.76%, you would expect mortgage rates to average approximately 5.85%. This connection highlights how closely mortgage rates track with movements in the Treasury yield over time.

Keep in mind that mortgage rate trends can shift as the economy changes. There will always be some ups and downs along the way. Factors such as the overall economy, job growth, and inflation will continue to influence how these dynamics play out.

Looking ahead, experts project a gradual decline in mortgage rates through 2026, and the current signs point in a positive direction.

Bottom Line

Staying on top of these changes can feel overwhelming, which is why having a trusted real estate agent or lender on your side is so important. They can guide you through the process, monitor rate movements, and help you make well-informed decisions.

If you want real-time updates on mortgage rates and insights into how they affect your buying or selling plans, let’s connect so you can stay prepared for what comes next.