You have probably heard that many homeowners today have significant equity. But what does that actually mean for you?

Home equity is more than just a number on paper. It is a valuable asset that can give you flexibility, options, and the ability to take your next big step with confidence.

How Much Equity Does the Typical Homeowner Have?

Here’s how equity builds. As you pay down your mortgage and home values increase over time, the portion of your home that you truly own grows. That ownership stake is your equity.

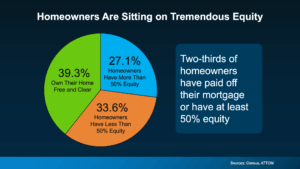

According to data from the U.S. Census Bureau and ATTOM, about two-thirds of homeowners have built a significant amount of equity.

In fact, 39 percent own their homes outright with no mortgage at all, and another 27 percent have at least 50 percent equity in their properties (see chart below):

That is significant. To put it into perspective, Cotality reports that the typical homeowner has nearly $300,000 in equity today. That is a six figure asset sitting in your home.

Whether your equity is close to that amount, higher, or somewhat lower, it can still create meaningful opportunities. Here are a few ways you could put it to work.

Ways You Could Use Your Home Equity

- Move Into a Home That Better Fits Your Life – Your housing needs naturally evolve over time. Maybe your current home feels too small, or perhaps you now have more space than you need. Your equity can help fund the next chapter. It can serve as a substantial down payment on a home that better fits your lifestyle today and in the years ahead. In some cases, homeowners even have enough equity to purchase their next home outright with cash.

- Upgrade Your Current Home – If you are not ready to move, you can reinvest your equity into your current home. Strategic upgrades, such as a kitchen update or refreshed bathrooms, can increase your home’s value when it is time to sell. Before starting any major projects, it is wise to consult with a real estate agent. An experienced agent can help you focus on improvements that are most likely to deliver the strongest return on investment.

- Fund a Major Life Goal – Home equity can also support important life goals. Whether you are starting a business, strengthening your retirement plan, covering education expenses, or helping someone you care about, that built-up value can provide meaningful financial flexibility. Some homeowners even use a portion of their equity to help a loved one with a down payment on a home, creating opportunities for the next generation.

- Avoid Foreclosure in Tough Times – If you are facing financial challenges, your equity can also serve as a safety net. Many homeowners who experience hardship are able to sell their homes and walk away with funds in hand rather than facing foreclosure.

If this is a concern for you, speaking with a real estate professional about your options can help you understand how your equity may provide a path forward.

Your Next Steps

If you are considering using your equity for any of these goals, here is how to get started:

Step 1: Request a personalized equity assessment from a local real estate agent.

Step 2: Meet with a financial advisor to discuss how using your equity fits into your overall plan.

Before tapping into this asset, there are important factors to consider. One key metric is your loan-to-value ratio, or LTV. Even if you access some of your equity, you generally want to maintain at least 20 percent ownership as a financial cushion. Many homeowners learned the importance of this the hard way during the 2008 housing crisis.

The good news is that, according to the Intercontinental Exchange, most homeowners today have equity levels that meet or exceed this guideline:

“As of Q4, mortgage holders have $17.3T in home equity, including $11.2T in tappable equity ‒ accessible via cash-out refinances or home equity lines while maintaining 20% equity in the property…”

Bottom Line

Your home equity may be one of your largest financial assets. Whether you are considering a move, planning renovations, or working toward a major life goal, it is worth taking the time to understand your options.

Reach out to us to start the conversation. We can connect you with a trusted financial advisor and help you explore the best path forward.