You’ve likely been waiting what feels like forever for mortgage rates to finally shift, and last week they did in a major way.

On Friday, September 5th, the average 30-year fixed mortgage rate dropped to its lowest level since October 2024. It marked the largest single-day decline in more than a year.

What Caused the Drop?

Mortgage News Daily reports the decline was sparked by the August jobs report, which came in weaker than expected for the second month in a row. This sent signals across the financial markets, leading mortgage rates to move lower.

In short, the data suggests the economy may be slowing, and as confidence builds around that direction, the markets are adjusting to what is likely ahead. Historically, that tends to bring mortgage rates down.

Why Buyers Should Take Notice Now

This isn’t only about a single headline or report. It’s about what the drop means for you.

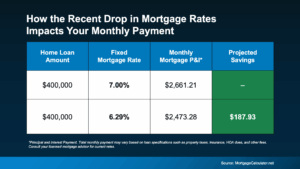

The recent shift can translate into real savings when purchasing a home. The chart below highlights an example of what a monthly mortgage payment (principal and interest) looks like at 7% (the average back in May) compared to where rates are today.

Compared to only four months ago, your future monthly payment could be nearly $200 lower each month. That adds up to about $2,400 in yearly savings.

How Long Will It Last?

Where rates go next will depend on the economy and inflation. They could move lower, or they might edge up slightly.

That’s why it’s important to stay connected with a knowledgeable agent and a trusted lender. They’ll monitor inflation data, job market trends, and upcoming Fed policy decisions to help gauge what might be ahead for mortgage rates.

For now, here’s the key takeaway. While no one can predict the future with certainty, the fact that rates have finally broken out of their months-long rut is a positive sign. If you’ve been feeling stuck, this shift could be the beginning of a new chapter. As Diana Olick, Senior Real Estate and Climate Correspondent at CNBC, explains:

“Rates are finally breaking out of the high 6% range, where they’ve been stuck for months.”

That gives you more reason for optimism than you’ve had in quite a while.

Bottom Line

This is the change you’ve been waiting for.

Mortgage rates just experienced their biggest drop in more than a year. If they hold near this level, a home that may have felt out of reach a few months ago could now be within your budget.

Curious how today’s rates could impact your future monthly payment? Let’s connect and explore your options.