If you’ve been hesitant to buy a home due to high mortgage rates, now may be a good time to revisit the market. Mortgage rates have been steadily declining in recent weeks, creating an opportunity for potential buyers to re-engage.

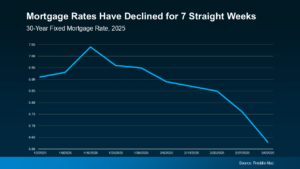

According to Freddie Mac, mortgage rates have fallen for seven consecutive weeks, now reaching their lowest point so far this year (see graph below).

While this shift may seem modest, it’s significant. The drop from rates above 7% to the mid-6% range can make a meaningful difference in your homebuying outlook.

What’s more, this milestone arrived earlier than expected — forecasts had predicted we wouldn’t see these numbers until around Q3 of this year (see graph below).

Why Are Rates Coming Down?

Joel Kan, Vice President and Deputy Chief Economist at the Mortgage Bankers Association (MBA), attributes the recent dip in mortgage rates to growing economic uncertainty:

“Mortgage rates declined last week on souring consumer sentiment regarding the economy and increasing uncertainty over the impact of new tariffs levied on imported goods into the U.S. Those factors resulted in the largest weekly decline in the 30-year fixed rate since November 2024.”

This recent decline comes at an ideal time, offering some welcome relief as we head into the spring market. However, it’s important to keep in mind that mortgage rates can be unpredictable, so some volatility is likely. The current downward trend may provide a valuable window of opportunity to maximize your purchasing power.

What Lower Rates Mean for Your Buying Power

Even slight changes in mortgage rates can have a notable impact on your monthly payment. The chart below illustrates how this plays out. It compares the monthly principal and interest payment on a $400K home loan if you had purchased when rates peaked at 7.04% in mid-January (this year’s highest point) versus what that payment could look like with today’s lower rates (see below):

In just a few weeks, the estimated monthly payment on a $400K loan has decreased by over $100—a meaningful savings that can make a big difference when budgeting for a home purchase. When it comes to such an important financial decision, every dollar counts.

It’s worth noting that recent economic factors have driven rates down more quickly than anticipated, but this trend could shift, leading to potential volatility in the near future. If you’re holding out for rates to drop even further, consider the opportunity available now if you’re ready to move forward.

Bottom Line

Mortgage rates have recently declined, offering buyers some welcome relief. If you’ve been waiting for rates to improve before entering the market, now could be your opportunity.

Would a lower monthly payment make homeownership feel more achievable for you? Let’s take a closer look at the numbers to see what it could mean for your budget.