After years of high mortgage rates and cautious buyers, the housing market is finally showing signs of renewed activity. More homeowners are listing their properties, and buyers are starting to engage again. For the first time in a long while, there is noticeable movement in real estate.

It is not a dramatic surge, but it is a clear shift that could set the stage for a stronger housing market in 2026.

So what is driving this slow comeback in real estate? Here are three key trends helping revive the housing market today and what they mean for buyers and sellers.

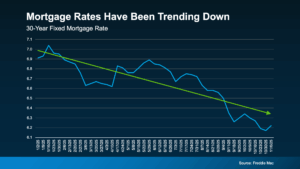

1. Mortgage Rates Have Been Coming Down

Mortgage rates naturally fluctuate over time, and some ups and downs are expected, especially with the current economic uncertainty. What matters most is the bigger trend over time.

Looking at the overall picture, mortgage rates have been trending downward for most of this year (see graph below).

In just the past few months, mortgage rates have reached their lowest levels of 2025. Sam Khater, Chief Economist at Freddie Mac, explains:

“On a median-priced home, this could allow a homebuyer to save thousands annually compared to earlier this year, showing that affordability is slowly improving.”

Why does this matter for you? Lower rates directly affect what you can afford. They mean reduced borrowing costs and increased buying power.

For example, Redfin data shows that a buyer with a $3,000 monthly budget can now afford a home roughly $25,000 more expensive than one year ago. This increase in affordability is a major factor driving renewed activity in the housing market.

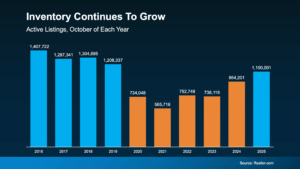

2. More Homeowners Are Ready To Sell

For some time, many homeowners chose to stay in their homes to keep their low mortgage rates. This “lock-in effect” limited housing inventory and slowed market activity. While many homeowners are still remaining in place, declining mortgage rates and life changes, such as job moves or growing families, are encouraging more people to sell, which is gradually increasing available homes for sale.

According to Realtor.com, the number of homes for sale has grown significantly. The market is now approaching inventory levels not seen in the past six years (see the blue section on the graph below). This increase in housing inventory is a key trend supporting the current real estate market recovery.

The return to more normal inventory levels is a positive development for the housing market. Buyers now have more options than they have in years, and this increase in available homes is helping move the market closer to balance.

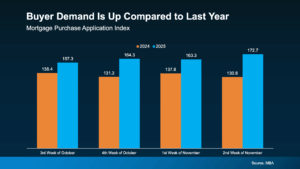

3. More Buyers Are Re-Entering the Market

It is not just sellers who are making moves. With more options and slightly improved affordability, buyers are returning to the market as well. The Mortgage Bankers Association (MBA) reports that purchase applications are up compared to last year, showing that demand is steadily building again (see graph below).

Experts believe this momentum will continue. Economists from Fannie Mae, the Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR) all forecast moderate home sales growth heading into 2026.

This recovery will not happen overnight. It is not a sudden surge, but it marks the beginning of steady improvement in the housing market as we move into 2026. For buyers and sellers alike, this gradual recovery is a welcome change.

Bottom Line

After several slower-than-normal years, the housing market is finally showing signs of improvement. Declining mortgage rates, increasing home listings, and growing buyer activity all indicate a market gaining real momentum.

Let’s connect to discuss what is happening in our local real estate market and how you can take advantage of these opportunities in 2026.