If you’ve been searching for a home recently, you’ve probably felt the pressure of today’s mortgage rates. With both rates and home prices on the rise, many buyers are exploring different loan options to help make homeownership more attainable. One option growing in popularity? Adjustable-rate mortgages, or ARMs.

If the term brings back memories of the 2008 housing crash, you’re not alone. But rest assured—today’s ARMs are much different.

Back then, some buyers were approved for loans they ultimately couldn’t afford once the rates adjusted. Now, lenders are much more cautious, requiring borrowers to qualify based on their ability to handle potential rate increases. So, the return of ARMs isn’t a red flag—it’s simply a sign that some buyers are getting creative in today’s challenging market.

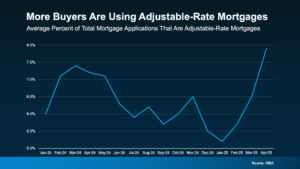

Take a look at this data from the Mortgage Bankers Association (MBA). It shows a growing number of buyers are turning to ARMs right now (see graph below):

While ARMs aren’t the right fit for everyone, they can offer some valuable benefits in the right circumstances.

How an Adjustable-Rate Mortgage Works

Business Insider breaks down the key difference between fixed-rate and adjustable-rate mortgages like this:

“With a fixed-rate mortgage, your interest rate remains the same for the entire time you have the loan. This keeps your monthly payment the same for years . . . adjustable-rate mortgages work differently. You’ll start off with the same rate for a few years, but after that, your rate can change periodically. This means that if average rates have gone up, your mortgage payment will increase. If they’ve gone down, your payment will decrease.”

It’s worth noting that with a fixed-rate loan, things like property taxes or homeowners insurance can still affect your monthly payment over time—but the core mortgage payment stays steady. That’s not the case with adjustable-rate mortgages, where your payment can shift more noticeably once the initial fixed period ends.

Pros and Cons of an ARM

Here’s a bit more insight into why some buyers are giving ARMs a second look—they come with some attractive advantages, especially in today’s high-rate environment. One of the biggest perks? A lower initial interest rate. As Business Insider explains:

“Because ARM rates are typically lower than fixed mortgage rates, they can help buyers find affordability when rates are high. With a lower ARM rate, you can get a smaller monthly payment or afford more house than you could with a fixed-rate loan.”

Of course, the trade-off is that ARMs don’t stay the same over time. Your rate—and monthly payment—can change once the initial fixed period ends. As Barron’s puts it:

“Adjustable-rate loans offer a lower initial rate, but recalculate after a period. That is a plus for borrowers if rates come down in the future, or if a borrower sells before the fixed period ends, but can lead to higher costs if they hold on to their home and rates go up.”

So while the upfront savings can make a big difference right now, it’s important to consider the long-term picture. If you’re planning to stay in the home beyond that initial fixed period, you’ll want to be prepared for the possibility of a rate increase. And while experts expect rates to ease somewhat over the next year or two, nothing is guaranteed.

That’s why it’s a smart move to sit down with your lender and financial advisor to go over all your options. They can help you weigh the pros and cons and decide if an ARM is a good fit for your financial goals and your comfort level with future rate changes.

Bottom Line

For the right buyer, adjustable-rate mortgages (ARMs) can offer some meaningful advantages—but they’re not a one-size-fits-all solution. The key is understanding how they work, carefully weighing the pros and cons, and considering whether they align with your financial plans and comfort level.

That’s why it’s so important to have a conversation with a trusted lender and financial advisor before making any decisions. They can help you explore your options and determine whether an ARM is the right fit for your situation.

If you’re thinking about making a move or just want to learn more about what loan options might work best for you, let’s connect. I’d be happy to point you in the right direction.