If you’ve been putting off buying a home because you assumed getting approved for a mortgage would be too difficult, it might be time to take another look. The good news is that while lending standards remain solid and responsible, qualifying for a mortgage is gradually becoming more achievable especially for buyers with strong financial profiles.

Many lenders are beginning to ease up on some of their more stringent requirements, making it a little easier for well-qualified buyers to access the financing they need. This shift is creating new opportunities for those who are ready to take the next step toward homeownership, without bringing back the overly risky lending practices that contributed to the 2008 housing crisis.

So, if strict guidelines were one of the reasons you’ve been sitting on the sidelines, this could be the window you’ve been waiting for. Now may be a great time to explore your options, get pre-approved, and see what’s possible in today’s market with the right guidance and support.

Lenders Are Opening More Doors

In an effort to spark more activity in the housing market, banks are beginning to offer credit to a broader range of buyers including those with lower credit scores or smaller down payments. That’s led to more people getting approved for mortgages and taking steps toward homeownership.

But if you’re wondering whether this could lead to another crash like we saw in 2008, there’s no need to worry. While lending has become a bit more flexible recently, today’s standards are still far more responsible and regulated than they were back then.

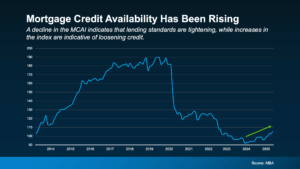

One key way to track how accessible mortgage credit is today is through the Mortgage Credit Availability Index (MCAI), published by the Mortgage Bankers Association (MBA). This index measures how easy, or difficult, it is for borrowers to get a mortgage.

And here’s the encouraging part: in May, the MCAI reached its highest level in nearly three years. That rise signals that lenders are slowly easing standards in a careful, controlled way, opening the door for more qualified buyers without repeating the mistakes of the past.

Why does this matter to you? Because it could mean you’re in a better position to qualify for a mortgage today than you were just a few months ago.

According to the National Association of Mortgage Underwriters (NAMU), mortgage credit availability saw a significant jump in May, reaching its highest level since August 2022. That shift signals a growing willingness among lenders to ease underwriting standards slightly, giving more buyers access to a wider range of financing options.

In short, if tight lending rules were holding you back before, now might be the perfect time to take another look at what’s possible. The door to homeownership may be more open than you think.

But What About 2008?

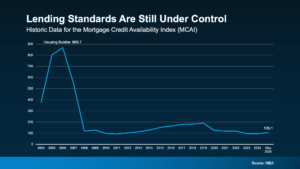

Now, you might be wondering, “Didn’t looser lending standards contribute to the 2008 housing crash?” That’s a great question and a valid concern. But here’s what’s different this time around.

While it’s true that credit availability is increasing, lending standards today remain well-regulated and much more controlled than they were in the lead-up to the housing crisis.

In fact, if you look at the Mortgage Credit Availability Index (MCAI) going all the way back to 2004, today’s lending environment is still far more conservative compared to the years before the housing bubble. (See graph below.)

So yes, getting approved may be getting a little easier, but the safeguards are still very much in place.

So, the recent increase in mortgage credit availability isn’t something to worry about, it’s actually a positive development for anyone thinking about buying a home.

As Brett Hively, Senior Vice President of Mortgage, Finance, and Strategy at Ameris Bancorp, put it:

“This uptick is opening the door for many borrowers to move forward with a home purchase or a refinance program.”

In other words, more buyers now have a real chance to make their move. Whether that means purchasing their first home, upgrading, or refinancing into better terms. It’s a welcome shift in today’s market, especially for those who may have felt stuck on the sidelines.

Bottom Line

So, if you’ve been holding off because you assumed getting approved for a mortgage was out of reach, now’s a great time to explore what’s possible. Lending conditions have shifted just enough to create new opportunities especially for well-prepared buyers.

Let’s connect and take a closer look at your options. You might be closer to homeownership than you think.