With prices climbing across the board, it’s understandable to have questions about how that impacts the housing market. Some are even concerned that rising costs could lead to more homeowners falling behind on their mortgage payments and possibly spark a surge in foreclosures. Recent reports showing an uptick in foreclosure filings may seem alarming at first glance — but it’s important to take a step back.

When you look at the bigger picture, the data shows we’re not headed for a repeat of the last housing crash.

This Isn’t Like 2008

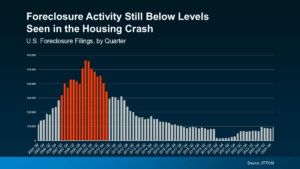

While it’s true that foreclosure filings saw a slight uptick in ATTOM’s most recent quarterly report, they remain well below historical averages — and far below the levels we saw during the housing crisis. Seeing the data visually really puts it in perspective.

When you compare Q1 2025 (shown on the far right of the graph) to the years leading up to and following the 2008 crash (highlighted in red), it becomes clear that today’s market conditions are fundamentally different and far more stable.

Back in the lead-up to the housing crash, loose lending practices left many homeowners with mortgages they simply couldn’t afford. That triggered a flood of foreclosures, oversaturating the market with distressed properties, driving home prices down sharply, and creating a ripple effect that impacted the entire economy.

Today’s market is fundamentally different. Lending standards are far more rigorous, and most homeowners have stronger credit profiles, more equity, and healthier financial footing. That’s a big reason foreclosure activity is significantly lower this time around.

And if you’re looking at 2020 or 2021 and wondering why today’s numbers are higher, here’s the key context: during the pandemic, a foreclosure moratorium helped millions of homeowners stay in their homes. That temporary pause brought filings to historic lows — so naturally, the numbers have ticked up as those protections expired.

Rather than comparing today to that unusual low point, it’s more accurate to look at pre-pandemic years like 2017 to 2019. When you do that, you’ll see that current foreclosure levels are still below what’s considered normal — and far below what we experienced during the crash.

Yes, every foreclosure represents a difficult situation for the people involved, and those impacts are very real. But on a broader scale, the data doesn’t suggest a housing market in distress. Quite the opposite — it points to a more resilient, better-balanced environment.

Why We Haven’t Seen a Big Surge in Foreclosures

Here’s another important factor that should offer some peace of mind: homeowner equity. Over the past several years, rising home prices have allowed many homeowners to build up substantial equity — giving them a much-needed financial buffer in times of uncertainty.

Rob Barber, CEO of ATTOM, puts it this way: “While levels remain below historical averages, the quarterly growth suggests that some homeowners may be starting to feel the pressure of ongoing economic challenges. However, strong home equity positions in many markets continue to help buffer against a more significant spike . . .”

In other words, if someone finds themselves in a tough spot and can’t keep up with their mortgage payments, they may still be in a position to sell their home and avoid foreclosure altogether. That’s a major difference from 2008, when many homeowners were underwater — owing more on their mortgages than their homes were worth — with few options but to walk away.

Don’t underestimate the impact of equity in today’s market. As Rick Sharga, Founder and CEO of CJ Patrick Company, noted in a recent Forbes article: “…a significant factor contributing to today’s comparatively low levels of foreclosure activity is that homeowners—including those in foreclosure—possess an unprecedented amount of home equity.”

This equity isn’t just a safety net — it’s one of the main reasons the housing market today is far more stable than it was during the last downturn.

Bottom Line

Even with the recent increase, foreclosure activity remains far below the levels seen during the 2008 crash. One major reason for this stability is that most homeowners today have built significant equity in their properties, which provides a financial cushion even amid rising costs.

If you’re a homeowner experiencing financial hardship, don’t wait — reach out and we’ll help you explore potential solutions. There are often options available to help you stay in your home or transition in a way that protects your investment.