If you’ve noticed headlines about falling home prices, you might be concerned about what it means for your home’s value. The reality is that even with minor declines in some markets, most homeowners are still in a strong position because of the equity they’ve built in their homes.

The Relationship Between Home Prices and Equity

Home equity generally follows the movement of home prices. When prices increase, equity grows, and when prices slow down, equity growth slows as well.

After the record-setting home price surge of 2020 and 2021, some cooling was expected. During that time, the number of homes for sale was at a record low, which drove values and equity higher as buyers competed for limited options. Prices could not keep rising at that pace indefinitely, and the market has started to moderate.

With more homes available this year, price growth has slowed, and equity gains have slowed too. That does not mean you have lost value in your home.

Putting it into Perspective

You probably still have far more equity than you did just a few years ago. That puts you in a strong position if you want to sell. Here’s the data to show why.

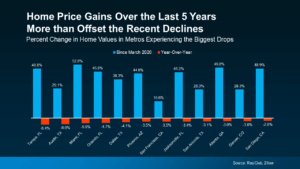

According to research from Zillow, home prices have risen about 45% nationwide since March of 2020. That is a significant increase.

In most markets, prices are still rising, just at a slower pace. Even in the metros experiencing the largest declines, the ones making headlines, the average drop is only around 4 percent.

So what does this mean? In most areas, prices are still going up, so there is little to worry about. In the few markets where prices are cooling, the five-year gains more than offset these small dips.

In other words, these modest declines cannot erase years of growth. Homeowners who have lived in their homes for several years are still far ahead, and that is true in nearly every market.

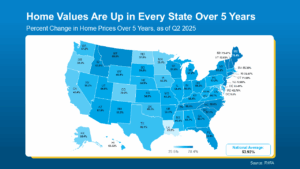

Data from the Federal Housing Finance Agency (FHFA) helps illustrate this point. Looking at a state-by-state level, every state has seen home prices increase over the past five years. This means homeowners in each state have significantly more equity than they did five years ago (see graph below).

In most areas, if you have owned your home for several years, you have likely built equity that many people could only dream of before the pandemic. That equity can give you flexibility if you decide to sell, whether you want to downsize or move up.

If you are concerned that prices might crash and affect your equity, Jake Krimmel, Senior Economist at Realtor.com, offers reassurance:

“The slight recent declines in aggregate value and total home equity are not cause for concern. Although the market is coming into better balance, large price declines nationally are extremely unlikely in the near term.”

The recent moderation in prices is not something to worry about. It is a sign that the market is finding balance after several years of rapid price growth. Even with slower growth, most homeowners remain in a very strong position.

Bottom Line

Even with prices softening in some markets, today’s homeowners are still holding near-record levels of equity.

If you are curious about how much equity you have or how far ahead you really are, let’s connect. You might be surprised at what your home is worth today.