The biggest regret homeowners have when they sell without an agent is pricing their home incorrectly for today’s market. Recent data from the National Association of Realtors shows that sellers who went the DIY route say setting the right price was the most challenging part of the entire process. Top 5 Challenges Sellers Face Without an Agent Pricing the home correctly Getting the house...

Home Prices

Curious about what the housing market will look like in 2026? You are not alone. For the past few years, affordability has been the biggest hurdle keeping many people from making their next move. Many buyers and sellers have been waiting for conditions to improve. The good news is that it is finally happening. In 2025, affordability reached its best level in three years, and experts expect that momentum...

After years of high mortgage rates and cautious buyers, the housing market is finally showing signs of renewed activity. More homeowners are listing their properties, and buyers are starting to engage again. For the first time in a long while, there is noticeable movement in real estate. It is not a dramatic surge, but it is a clear shift that could set the stage for a stronger housing market in...

If there were one simple step that could make your home sale smoother and more predictable, wouldn’t you want to know about it? A lot happens between the moment your house goes under contract and the day you close. Several things need to go right for the deal to stay on track. What many sellers don’t realize is that most hiccups during this stage can actually be prevented. That’s where the...

Over the past few years, many homebuyers have struggled to make the numbers work. Home prices climbed, mortgage rates rose, and for a lot of people, buying a home simply didn’t feel within reach. You may have felt the same way. Now there’s some encouraging news. If you’ve been waiting for a better moment to reenter the market, this fall could be showing early signs of improved...

As the market continues to cool, many homeowners who didn’t achieve the price they were aiming for are deciding to pull their homes off the market. According to the latest data from Realtor.com, the number of homeowners making that choice has jumped 38% since the start of this year and 48% compared to last June. To give that some context, for every 100 new listings in June, about 21 homes were removed...

Powell Hints at Change At the Jackson Hole Economic Policy Symposium on August 22, 2025, Federal Reserve Chair Jerome Powell suggested that a Federal Reserve rate cut may be coming in September. He acknowledged that while inflation in 2025 remains above the Fed’s 2% target, slowing job growth is raising concerns. Powell stressed that the Fed will remain data-driven and independent from politics, leaving...

Mortgage rates are still a hot topic, and for good reason. After the most recent jobs report came in weaker than expected, the bond market reacted almost instantly. As a result, in early August mortgage rates dropped to their lowest point so far this year at 6.55%. While that may not seem like a huge shift, many buyers have been waiting for rates to ease. Even a modest drop like this gives hope that we...

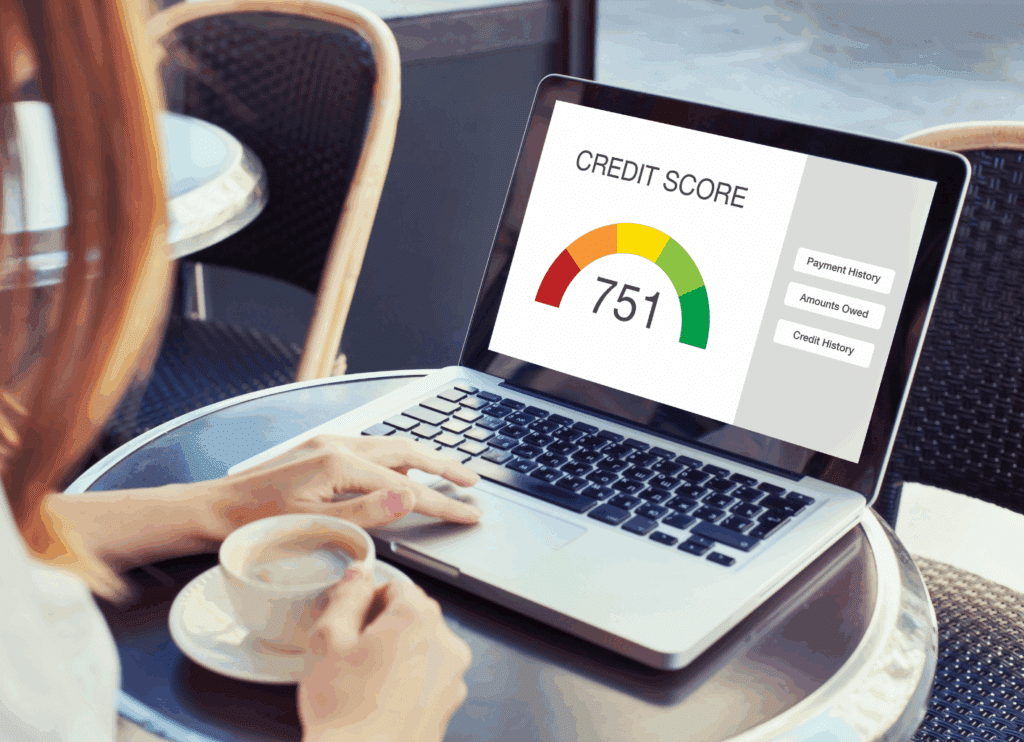

According to Fannie Mae, 90% of buyers either don’t know what credit score lenders are actually looking for or assume it needs to be higher than it really is. That’s a big deal, because it means many potential homebuyers may be holding back unnecessarily, thinking they don’t qualify. You might even be one of them. But the truth is, the requirements may be more accessible than you think. Let’s...

If you've been keeping an eye on the market, you've probably already noticed some changes this year. So, what's on the horizon? From home prices to mortgage rates, here’s what the latest expert forecasts predict for the remainder of 2025 and what these shifts could mean for you. Will Home Prices Fall? Many buyers are hoping home prices will drop soon, and recent headlines showing slight dips in some...