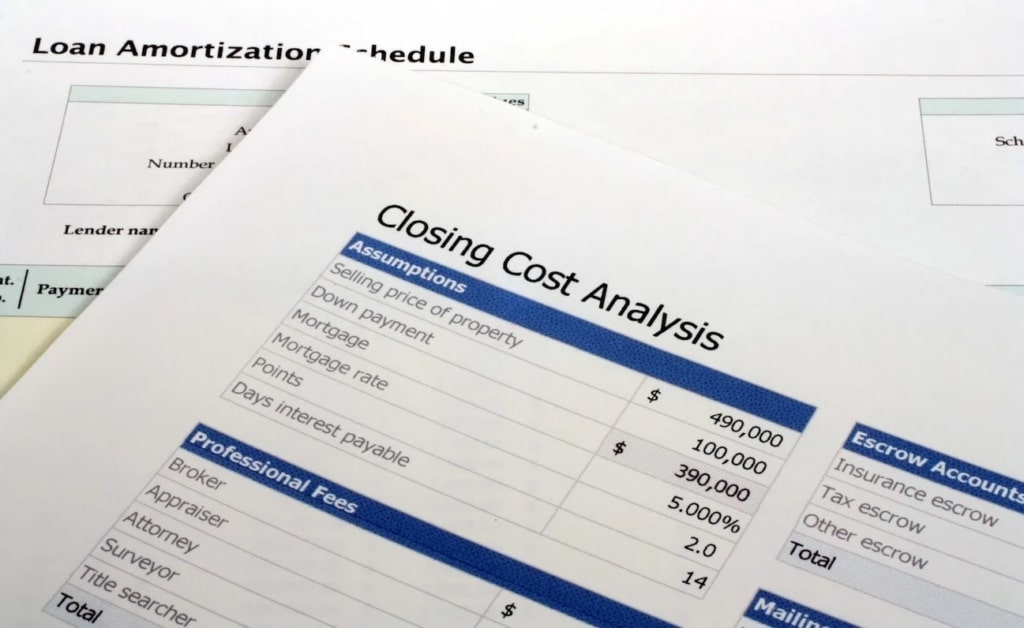

Now that you've made the decision to buy a home and are ready to move forward, it's important to plan for the typical costs involved in the homebuying process.

Mortgage

It’s natural to feel uncertain about what lies ahead with the upcoming Presidential election. This uncertainty can lead to concerns if you’re buying or selling.

If you're considering moving this year, you're likely concerned about two key housing market factors: home prices and mortgage rates.

If you're considering purchasing a home, you're probably thinking about mortgage rates. You're aware of how they affect your monthly payment...

Recent news might have you wondering about the future of mortgage rates. You might have heard predictions about rate cuts this year that were expected to lower.

Purchasing your first home is a significant and thrilling milestone that can enhance your life. As a first-time homebuyer, it's a dream within reach...

Are you working towards owning a home? If you are, you might have come across the term "pre-approval." Let's explore what it means and why it's crucial if you're planning to purchase a home in 2024. What Pre-Approval Is During the homebuying process, your lender will assess your finances to determine the amount they're willing to lend you. This typically involves reviewing documents such as your...

If you are contemplating the acquisition of a home, the recent downturn in mortgage rates emerges as favorable news, contributing to an enhancement in affordability. Furthermore, this economic shift has the potential to motivate an increased number of homeowners to part ways with their properties, thereby presenting an additional advantage for you in your pursuit of homeownership. The Impact of...

If you're a bit confused about the current state of home prices, you're not alone. Despite data indicating otherwise, there are still claims that prices are dropping. This confusion stems from unreliable sources and misleading media coverage. To clarify things, let's focus on the essential information backed by trustworthy data. Normal Home Price Seasonality Explained In the real estate market,...

If you're planning to purchase a home in the current year, you're likely keeping a keen eye on mortgage interest rates. These rates play a significant role in determining the purchasing power of your home loan, and given the current affordability challenges, it's a valuable moment to examine the historical context of mortgage rates compared to their current levels. Additionally, it's crucial to grasp how...