You have probably heard that many homeowners today have significant equity. But what does that actually mean for you? Home equity is more than just a number on paper. It is a valuable asset that can give you flexibility, options, and the ability to take your next big step with confidence. How Much Equity Does the Typical Homeowner Have? Here’s how equity builds. As you pay down your mortgage and...

Education

If you’ve been waiting for mortgage rates to drop, the good news is that it is already happening. Recently, rates reached an important milestone, dipping into the 5 percent range for the first time in about three years. Today, rates are sitting in the low 6 percent range, and experts expect them to remain near this level throughout the year. Here’s why this matters for you as a homebuyer. Why...

The biggest regret homeowners have when they sell without an agent is pricing their home incorrectly for today’s market. Recent data from the National Association of Realtors shows that sellers who went the DIY route say setting the right price was the most challenging part of the entire process. Top 5 Challenges Sellers Face Without an Agent Pricing the home correctly Getting the house...

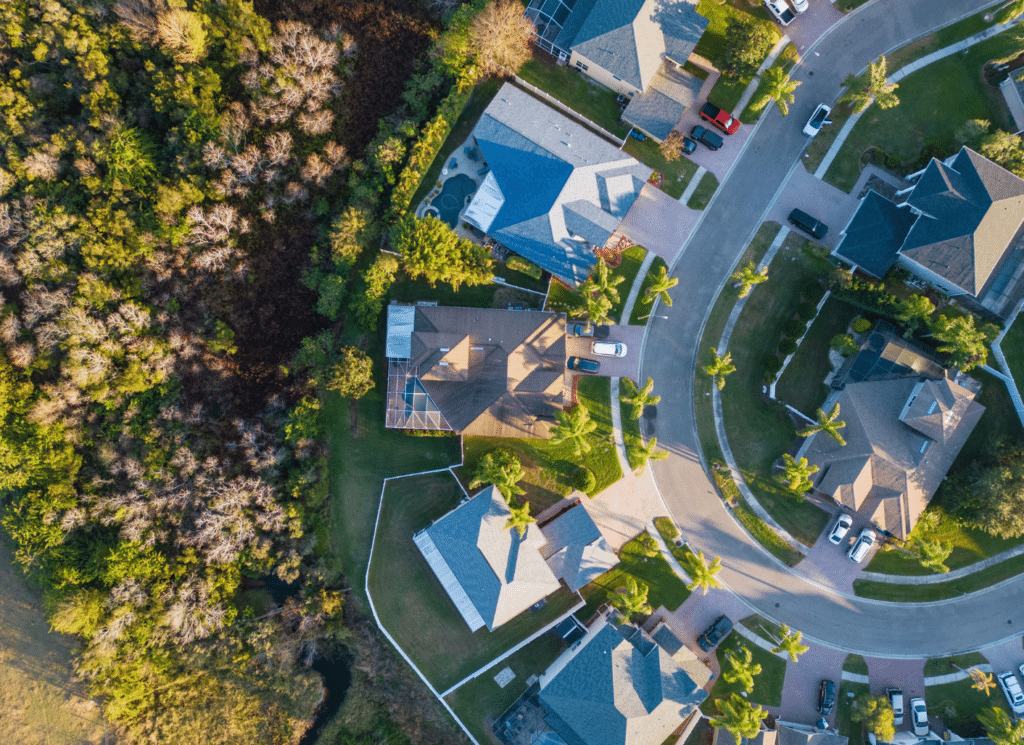

Curious about what the housing market will look like in 2026? You are not alone. For the past few years, affordability has been the biggest hurdle keeping many people from making their next move. Many buyers and sellers have been waiting for conditions to improve. The good news is that it is finally happening. In 2025, affordability reached its best level in three years, and experts expect that momentum...

If a move is on your radar for 2026, there is more working in your favor than there has been in quite some time. After a period when many people felt stuck, 2026 is shaping up to be a year with greater balance, more options, and clearer opportunities for those planning a move. This is not because the market has suddenly become easy, but because several key conditions are beginning to shift. Here is...

New home construction is giving buyers something they have not seen much of lately. It offers a real chance to get both the home they want and the deal they need. More newly built properties are hitting the market, and builders are offering incentives that make these homes more affordable than many people realize. This combination does not come around often, and it is putting buyers in a surprisingly...

After years of high mortgage rates and cautious buyers, the housing market is finally showing signs of renewed activity. More homeowners are listing their properties, and buyers are starting to engage again. For the first time in a long while, there is noticeable movement in real estate. It is not a dramatic surge, but it is a clear shift that could set the stage for a stronger housing market in...

If you’ve noticed headlines about falling home prices, you might be concerned about what it means for your home’s value. The reality is that even with minor declines in some markets, most homeowners are still in a strong position because of the equity they’ve built in their homes. The Relationship Between Home Prices and Equity Home equity generally follows the movement of home prices. When prices...

You’ve got big goals for 2026, and if selling your home is one of them, the work starts this year. What you do today could be the difference between a smooth sale and a stressful one. If you’re thinking of listing your home next spring, which is typically the busiest season in real estate, the smartest move is to begin your prep now. As Realtor.com explains: “If you’re aiming to sell in 2026,...

If you’ve been keeping up with real estate news, you may have noticed reports claiming that home prices are staying flat. At first, that might seem easy to understand. However, the truth is a bit more complex. In many markets, home prices are actually far from flat and continue to show movement. What the Data Really Shows While home prices have certainly cooled from the rapid, unsustainable surge seen...