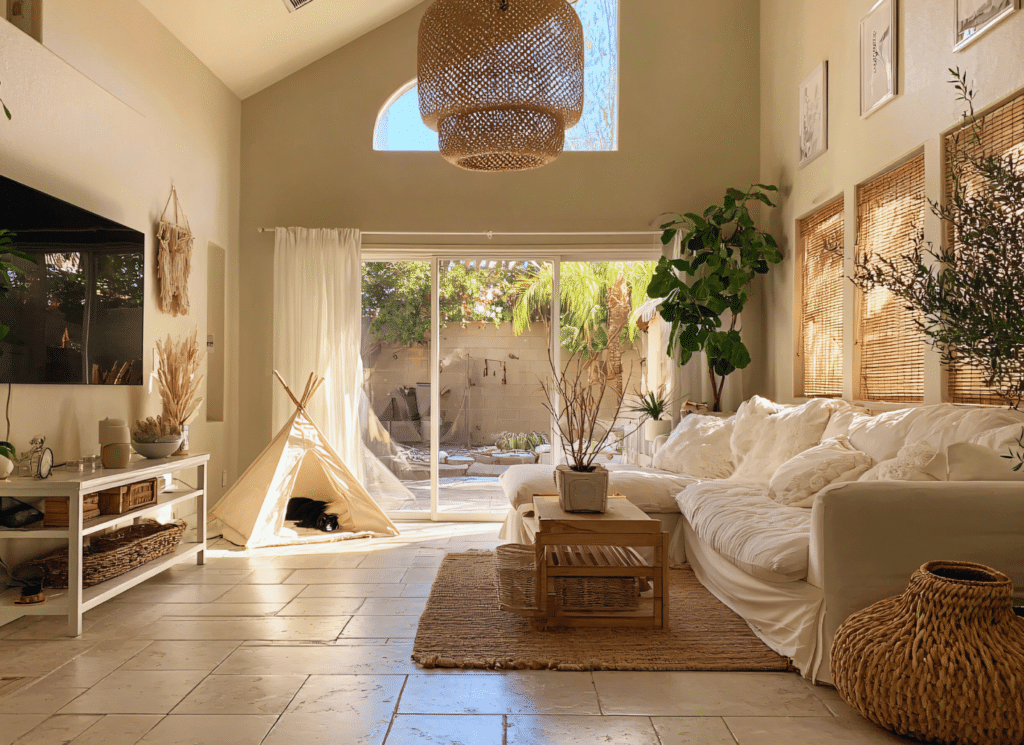

Perched in the scenic hills of the Calabasas Highlands, 23722 Summit Drive offers a rare opportunity to enjoy a beautifully updated home surrounded by sweeping canyon, mountain, and valley views. This serene enclave, known for its peaceful atmosphere, winding roads, natural landscapes, and tight-knit community, remains one of Calabasas’s best-kept secrets. This 3-bedroom, 3-bathroom residence...

LA Real Estate

New home construction is giving buyers something they have not seen much of lately. It offers a real chance to get both the home they want and the deal they need. More newly built properties are hitting the market, and builders are offering incentives that make these homes more affordable than many people realize. This combination does not come around often, and it is putting buyers in a surprisingly...

When the holidays arrive, travel plans, family gatherings, and the general chaos of the season may make you think it is better to take your listing off the market or wait until 2026 to sell your home. But here is the truth. Waiting could cause you to miss a strong window of opportunity. While many sellers step back during the holidays, you can stay active, and that choice may give you a competitive...

Why Buyers Searching in Woodland Hills and Topanga Trust This Team When you’re searching for a dream home in Woodland Hills, Topanga, or the exclusive guard-gated community of Summit Pointe Estates, the right guidance changes everything. And for Sam Wehrmeyer, that guidance came from a team that didn’t just help him find a home, they helped him find a community, a lifestyle, and lifelong...

After years of high mortgage rates and cautious buyers, the housing market is finally showing signs of renewed activity. More homeowners are listing their properties, and buyers are starting to engage again. For the first time in a long while, there is noticeable movement in real estate. It is not a dramatic surge, but it is a clear shift that could set the stage for a stronger housing market in...

If you’ve noticed headlines about falling home prices, you might be concerned about what it means for your home’s value. The reality is that even with minor declines in some markets, most homeowners are still in a strong position because of the equity they’ve built in their homes. The Relationship Between Home Prices and Equity Home equity generally follows the movement of home prices. When prices...

Nestled around the picturesque lake in Calabasas Park, one of the most sought-after neighborhoods in Calabasas, this home sale will always hold a special place in our hearts. Known for its scenic walking paths, waterfront homes, and peaceful atmosphere, Calabasas Park offers a lifestyle that’s as refined as it is welcoming. Helping our client, Jen Jones, sell her home here was not just a real estate...

If there were one simple step that could make your home sale smoother and more predictable, wouldn’t you want to know about it? A lot happens between the moment your house goes under contract and the day you close. Several things need to go right for the deal to stay on track. What many sellers don’t realize is that most hiccups during this stage can actually be prevented. That’s where the...

You’ve got big goals for 2026, and if selling your home is one of them, the work starts this year. What you do today could be the difference between a smooth sale and a stressful one. If you’re thinking of listing your home next spring, which is typically the busiest season in real estate, the smartest move is to begin your prep now. As Realtor.com explains: “If you’re aiming to sell in 2026,...

After a few years of a slower housing market, 2026 is shaping up to bring new momentum. Experts predict that more people will be ready to move, creating fresh opportunities for you to make your own move too. More Homes Will Sell Over the past few years, rising affordability challenges have caused many potential movers to hit pause on their plans. But that pause won’t last forever. There will always be...